4 Tips For Giving Kids an Allowance

Don’t pay your kid for scoring goals in a game.

Don’t pay them for achieving A’s on their report card or for eating their vegetables.

Don’t pay your child for doing the dishes, sweeping the floor, or scrubbing their toilet.

Instead pay your child a consistent allowance because he is a contributing, valued member of your family and you want to raise a financially responsible person.

The pay-for-performance debate has been a subject of discussion for families for generations. If we don’t tie the money we pay our kids to chores, grades, or other accomplishments, then why give them an allowance at all?

One way we can teach children financial responsibility is by giving them a consistent allowance and then helping our son or daughter learn how to save, spend, and give their money away.

1. WHY give an allowance?

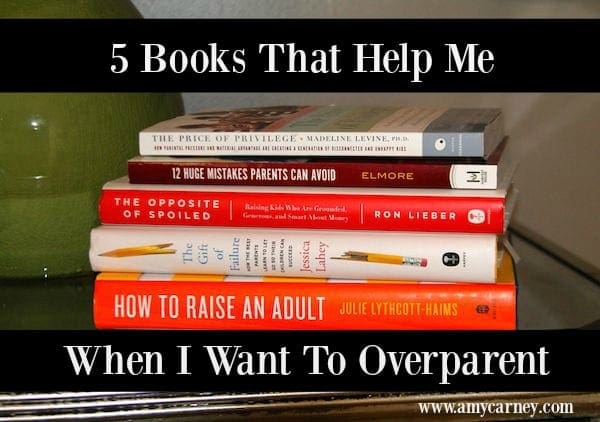

Our parental goal should be to raise independent adults who learn to manage money before they leave our home. An allowance is not about paying our kids to do what they should already be doing in the first place.

Don’t view allowance as a reward, but instead as a way for your son or daughter to learn how to handle money and financial responsibilities while living under your roof.

Have expectations for your kids to help regularly around the house and to work hard at school and their other endeavors, but be careful about the mixed messages you may send by paying them for their performance. What happens is we say we want to raise kind kids first and foremost, yet our sons or daughters see us pay them when they accomplish, not when they are kind.

2. HOW MUCH should we pay for an allowance?

The big question is always, what’s fair to pay a child for an allowance? Unfortunately, only we can define ‘fair’ within our own family.

A common rule of thumb is to give $1 per year of the age of the child each week. If your child is 7, that means he would receive $7 a week, $28 a month. According to this, a 15-year-old would receive $15 a week, $60 a month.

Allowance amounts should go up as the kids get older and have more responsibilities and expenses to pay for.

Do you want to pay them in cash or do you want to put the funds directly into their bank account? I recommend paying the allowance in cash so that your son or daughter gets to feel the transaction and learn to distribute the money into the bank appropriately.

3. WHEN should we pay an allowance?

It’s up to you to design a consistent rhythm for allowance payout in your family.

Once you’ve settled on the allowance amount, you need to figure out when payday will be. In our family, we had a routine of paying a monthly allowance to each child at our family meeting at the beginning of every month. Before figuring out this schedule that worked for us, the allowance was very inconsistent and sporadic.

Does it work best for your family to pay your child weekly or monthly?

4. WHAT will your child now be responsible for paying for?

An allowance is not just handing privileged kids more money so they can do and buy even more. Remember, the goal of giving an allowance to our kids is for them to learn how to manage money.

One way to teach our children financial responsibility is by giving them a consistent allowance attached to a list of things you are no longer willing to pay for.

Decide what your kids will be responsible for covering with their own money. Do they need to buy food for their pet hamster? Music downloads? Netflix subscriptions? School lunches? Haircuts?

What are you already paying for that you can transfer ownership of to your child?

When you put your son or daughter in charge of paying for their privileges, they begin to feel the transaction of earning and spending money. The goal is to allow our kids to feel the ‘pain’ of their spending habits. If their allowance isn’t enabling them to buy and do what they want, then perhaps they need to cut back their spending or get a job or start a business instead of relying on you for constant handouts.

The more you want your child responsible for paying for his or her things, the more cash you will most likely need to give for allowance. Remember you are already spending this money on a regularly anyway. You’re just transferring responsibility to your child in the form of an allowance.

When we first decided on a monthly allowance attached to a list of things our kids would now be responsible for paying for, our four teenagers did not like having to hand over $40 to us for their monthly cellphone bill. We wanted them to see that having an iPhone attached to a data plan can be expensive. Two of our high schoolers debated getting rid of their data plan because they weren’t sure that’s how they wanted to spend their money.

Our children will never think twice about the cost of owning an iPhone or buying those expensive athletic shoes if we continue to pay for these wanted items without involving them.

We need to teach our children that money, unfortunately, does not grow on trees and that it is, in fact, a limited resource.

Let’s pay our child an allowance because they are a contributing, valued member of our family and it’s our duty as a parent to raise a financially responsible adult.

How are you tackling allowance in your family? What’s working for you and what’s not?

You literally answered all of my questions in one blog post. Saving this!

Our kids are still young enough to be with us when buying things so we use a great app called Rooster Money to track allowance and spending. It’s easy to use and has great features.

Thanks for this tip! I hadn’t heard of this app yet!

I love love love this! In fact, my entire blog is about it! My daughter gets a payday every 2 weeks – like a typical job these days – and has responsibilities she MUST set money aside for (school fees, clothes, gifts, etc) and based on how she budgets that determines how much she gets to spend on her choosing. When she made the choice to drop $100 on Lululemon leggings instead of $30 on what I would consider high end ones at Target (or $5 from Walmart considering how quick she goes through them anyway), she also spent months going without additional spend money as her clothing budget was replenished.

Yes! It’s so good for them to see the sacrifices that they have to make when they decide to buy the Lululemon instead of a lesser version. Best they learn what that looks like now! Thanks for reading and commenting! Great blog you have!